Little-Known Reasons Not To Max Out 401(k) Retirement Savings Contributions

Everyone talks about maxing out retirement contributions. Saving for retirement is a big deal, and every year Americans are given a certain limit to contribute to tax-advantaged retirement accounts. Hitting these limits ensures you save as much as you possibly can in a tax-deferred or tax-limiting account destined to make a huge impact once you reach retirement age and start taking distributions. However, even with plenty of attention given to limits and maximizing contributions, there are actually a number of important reasons Americans should consider when opting not to hit these deposit caps.

Indeed, it's possible that for your own financial picture, maxing out contributions year after year will actually hurt you more than help. Fortunately, real-life financial situations that benefit from minimized or potentially even zeroed-out (in the short term) contribution strategies are easy to spot. Similarly, they're simple to plan around in an effort to change things for the better, and eventually return to regular, perhaps sizable contributions to your 401(k) and other retirement vessels.

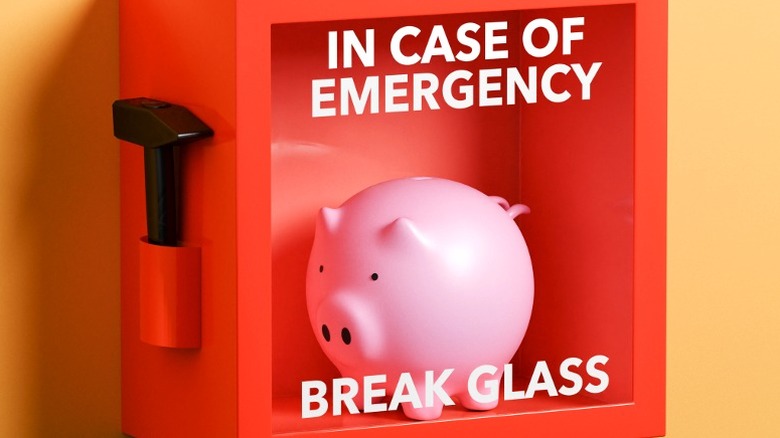

You're lacking a sufficient emergency savings

A good place to start is with your emergency savings fund. If you don't have any emergency savings set aside to see you through hardships, then you're setting yourself up for failure. Emergency savings should range between three and six months' worth of expenses, according to most experts. This might add up to a sizable savings account or something more modest, depending on your personal financial needs. Either way, a fully funded emergency reserve should be capable of kicking in to alleviate emergency spending needs, like a car repair. It should also act as a safety net in more dire circumstances like the sudden loss of your job, allowing you to look for new work without falling into a cycle of intense stress.

If you don't have an emergency savings reserve — 27% of Americans are in this boat, according to Bankrate's 2024 Annual Emergency Savings Report — pausing your 401(k) investments or at least slowing them down is a good idea. This shift in financial focus will allow you to initiate or build on your emergency savings, reducing short-term financial stress with each added dollar. Once you've established this critical safety net, returning to your longer term goals can be done with even greater enthusiasm.

You're dealing with high-interest debts

High-interest debt is a major burden that can wreak havoc on both short- and long-term financial stability. Some of the lowest interest credit cards offered today reach up into the 20% range, eclipsing the potential gains you can find on even the most promising investments. It's essential to invest in your future, of course, but if you aren't pouring enough resources into eliminating running debt burdens that are eroding your present financial standing, you're simply shifting the problem down the road — and making it more expensive in the process. For anyone dealing with substantial credit card debt, medical bills, or personal loan obligations that have high-interest figures attached to them, putting major retirement investment strategies on hold is likely the best play.

Personal finance personalities like Dave Ramsey have outlined this sort of strategy in depth. Ramsey's "Baby Steps" approach calls for developing an emergency fund first — starting with $1,000, and eventually growing from there — and then moving onto aggressive debt payoff. He suggests forgoing any retirement savings at all until you've regained control of your present-day financial picture. Whether you choose to contribute some money in the present or not, it's essential to hammer away at any looming debt burdens that cost you more each month than your investments can reasonably make with the help of compound interest and general asset appreciation.

You're saving up for another financial goal

Perhaps the most important purchase you'll ever make is your first home. Homebuyers are eager to move out of the rental sphere and into homeownership because it grants them an equity-building asset that they can live in and utilize on a daily basis. A home of your own gives you increased flexibility when it comes to personalization and decision making, and it grows with you as you make your way through life, and ultimately head toward retirement.

Saving to purchase your first home (or in an effort to move and buy a new property) is a solid financial goal, but it often requires sacrifices to be made elsewhere. Reducing your financial contributions to retirement savings can be one avenue that makes saving for a new home fit within the budget. This is especially true for families with young kids, or savers who are already juggling other financial obligations like a car payment. Even though saving for retirement is an important piece of the overall puzzle, limiting contributions for a short period of time to facilitate another critical financial goal is a perfectly reasonable approach to good financial stewardship on the whole. (Read about what first-time homebuyers often get wrong about buying a home.)

You're being realistic about your current finances

Finally, it's important to be realistic about your savings goals as they relate to existing financial realities in your life. The 401(k) contribution limit increased to $23,000 in 2024. If you're a low earner, setting aside a figure that even comes close to this limit isn't feasible. The same goes for plenty of middle and even high earners across America. With 77% of Americans living paycheck to paycheck (down 1% from 2023, per PayrollOrg's 2024 survey), most people simply won't have the financial leeway necessary to set aside this much money for the future.

Maxing out your retirement contributions (or achieving the maximum volume you can reasonably put away each year) can often require a saver to put short-term goals on hold. The tradeoff may be warranted in some years, but as a general rule, saving as much as you possibly can on a yearly basis may ultimately leave you feeling drained. In the same way that overworking yourself for too long can lead to burnout, never taking care of your short-term needs or allowing for splurge purchases and little treats from time to time is a great way to find yourself feeling hollow and overwhelmed.

Working hard to put money aside for retirement is admirable, but it should always be done with the context of today's needs in mind. You certainly don't need to go out for dinner three nights a week or go out with friends every weekend, but allowing yourself these kinds of pleasures from time to time will allow you to enjoy the here and now while also taking care of your future financial needs.