How Scammers Are Targeting The Country's Most Vulnerable

While scams are increasing across the U.S., a new wave of fraud targeting low-income Americans has left many of the country's most vulnerable reeling. Specifically, recipients of Supplemental Nutrition Assistance Program (SNAP) benefits have faced increased rates of fraud, resulting in many low-income families being unable to provide basic necessities for their families. According to United States Department of Agriculture data, 66,842 households were affected just during the second quarter of 2024 alone, leading to a loss of $32.5 million in benefits.

The primary method of this fraud centers on the way SNAP recipients receive their benefits. These funds are generally loaded onto electronic benefits cards (EBTS), which come with inherent security risks. EBT cards are especially at risk for something known as card skimming (or card cloning; it's one of the primary reasons we warn you to avoid paying for gas with a debit card as well), which can lead to detrimental consequences for SNAP beneficiaries. Cindy Long, administrator of the USDA Food and Nutrition Service, explained that "[w]hile card skimming and phishing scams can impact anyone who uses a credit, debit, or EBT card, they may hit SNAP households — who rely on their monthly benefits to buy food for themselves and their families — the hardest."

While the USDA has put out several scam alerts regarding SNAP benefits and has even added additional funding to replace stolen funds, it's less clear how it might combat the fraud altogether. Let's dive into who is being affected, and how exactly the fraudsters are catching their victims.

Who's being affected by this fraud

To understand just how detrimental scams are for SNAP recipients, it's important to understand the fundamentals of the program. SNAP, formally known as food stamps, provides low-income families with funds (generally paid through EBT cards) that can be used exclusively on groceries and food items. Similarly, some states in the country also offer cash-assistance programs (such as Temporary Assistance for Needy Families aka TANF and Special Supplemental Nutrition Program for Women, Infants, and Children aka WIC) that allow families to buy anything they might need, no strings or purchase categories attached.

While SNAP is technically a federal program, each state runs its own program or programs for administering benefits to a variety of demographics, including assistance for seniors, those with disabilities, or even those who are unhoused. Qualifying for individual programs can vary state to state, but recipients generally have resource and/or income limitations that qualify them for the program. This makes SNAP recipients an especially vulnerable population for scammers to target.

Most assistance programs are paid out monthly and use similar EBT cards for their recipients. This means benefit amounts are automatically loaded onto a physical card that recipients receive through their state system. These cards look similar to debit or credit cards, and work in a very similar way. As recipients make purchases, the amounts are debited from their loaded benefits account. However, unlike debit or credit cards that might have overdraft protection, if a SNAP beneficiary doesn't have available funds in their account, they are unable to make a purchase.

How scammers are doing it

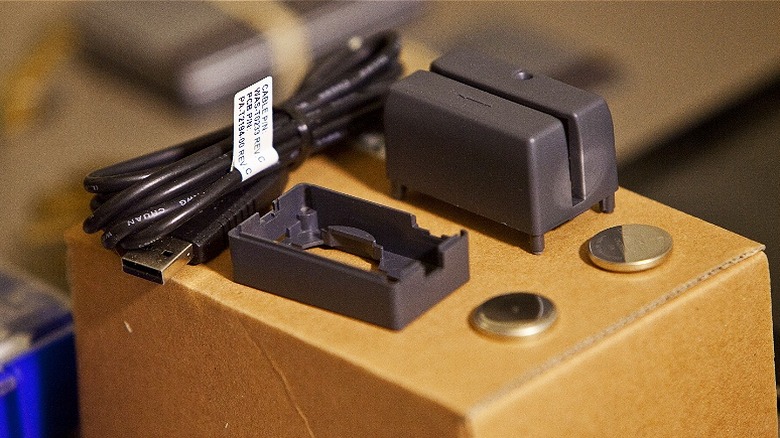

Card skimming relies on the installation of specific skimming devices, usually attached to a card swipe point-of-sale device or console, in stores, at ATMs, or any other accessible payment area (i.e., at the pump of gas stations). These devices generally look like the normal swipe portion of a point of sale, and are oftentimes physically attached to existing payment machines. However, some scammers even install false pin pads to capture a user's PIN. All of these tactics are done in an attempt to steal your card's information so that scammers can create a clone payment card to drain your account.

A big push for the creation and addition of microchips within consumer debit and credit cards was rooted in the added security those chips provided. The chips add a layer of encryption that protects a user's card information. However, most state-issued EBT cards do not use chip technology, instead relying on the more vulnerable magnetic-stripe card style. Not only is there no federal law requiring the addition of chips to EBT cards, but most state agencies responsible for issuing EBT cards would argue that the cost and labor required to transition to chip cards would be too great for their existing budgets. However, this lack of added protection has helped fuel the increased fraud affecting SNAP recipients and, worst of all, continues to perpetuate an unequal treatment of the country's most vulnerable populations.