The Big Difference Between Tax Evasion And Tax Avoidance

Tax season might have you questioning just what you can get away with on your return. From tax credits to write-offs and everything in between, questionable tax filings are increasingly problematic for the Internal Revenue Service. In fact, in 2022 alone, Americans owed over $120 billion in back taxes, penalties, and interest fees (with much of this stemming from less-than-honest tax practices). Even worse, the tax gap between what taxpayers owe and what the IRS collects has grown to more than $425 billion each year.

While most Americans aren't necessarily trying to actively participate in tax evasion, there does appear to be a growing amount of taxpayers seeking out tax avoidance strategies that could land them in trouble. It's important to realize that both tax evasion and avoidance have the same goal: to pay less in taxes. However, while both might start from a similar place, they do have some important distinctions.

Adam Brewer, a tax attorney, told Business Insider, "The big difference is that tax evasion is illegal while tax avoidance is legal and even celebrated. The end goal is the same, but how you get there is different." Meaning, if your tax avoidance strategy ends up breaking a federal, state, or local law, it's considered tax evasion. If you deliberately misrepresent or fail to report all or some of your income to the IRS, you're participating in tax evasion. This can have serious consequences — including jail time (the 2020 average was 16 months).

What exactly is tax avoidance?

Tax avoidance involves using legal means to minimize the amount of taxes you owe. This can include claiming credits, deductions, dependents, exclusions, or even adjustments to your reported income. Tax attorney Adam Brewer explained to Business Insider, "Tax avoidance is reporting your income, but then strategically claiming deductions you are allowed by law so that you pay less or no tax." A key element to tax avoidance (that makes it different from tax evasion) is that there's a clear trail of evidence that supports your eligibility for claimed tax breaks, and it proves your reported income is accurate.

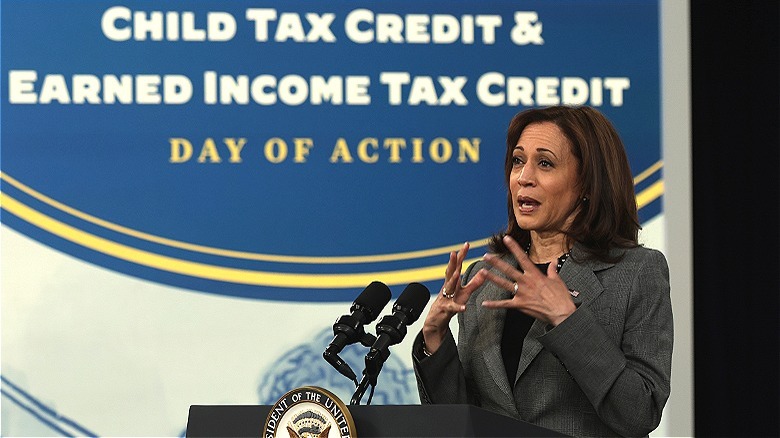

Tax avoidance is sometimes also referred to as tax shelter and it's used by millions of Americans every year. Some of the most common include child tax credits, annual contributions to retirement accounts, and putting money in a health savings account, or HSA. However, while tax avoidance is technically seen as a smart financial move, you have to be careful about the strategies you use.

You might not know about this, but every year the IRS puts together a "Dirty Dozen" list featuring the most prominent scams and tax "tips" to avoid. In 2022, the IRS expressively warned taxpayers to avoid certain tax avoidance strategies, given just how many of them are bogus. These misleading tax avoidance strategies can have unintended consequences for those who try them. These tax schemes can involve everything from misapplying charitable trust write-offs to concealing funds overseas to incorrectly reporting digital assets like cryptocurrency.

What to know about tax evasion

Underreporting is the main component of the growing tax gap between what Americans owe and what the IRS collects. An estimated $398 billion of the total $496 billion gap in 2022, for example, was due to taxpayers understating their incomes when filing their taxes. Underreporting, as well as hiding money (through offshore/other kinds of unidentifiable accounts), lying about or fabricating income sources, falsely claiming dependents, and overstating one's expenses (especially through a business) are some of the most common forms of tax evasion people try and get away with it. Tax evasion is a form of tax fraud, which can lead to steep penalties and consequences.

According to the IRS, 68.7% of those brought up on tax fraud charges in 2020 were sentenced to prison. Other penalties for tax evasion can include fines or a combination of both. Something to keep in mind is that the IRS has recently been on the receiving end of a substantial increase to its budget. As of September 2023, the IRS has even publicly stated it would be increasing the number of audits performed on tax filers. Specifically, the IRS has announced it'll be paying special attention to filers with an income above $1 million (and who have more than $250,000 in recognized tax debt). While the IRS also stated audit rates won't increase for any taxpayers earning less than $400,000 a year, there has still never been a better time to make sure your taxes are entirely above board.