EVs That Are Eligible For A Federal Tax Credit In 2024

Federal incentives continue to expand the renewable energy market for consumers across the country. From grants that help homeowners install solar power and reduce reliance on grid sources to tax credits for EV purchases, there's a lot to get excited about. Incentivizing car buyers to opt for a new electric vehicle rather than once with an internal combustion engine is part of the federal government's overarching goal of achieving 50% of all new car sales as electric by 2030. Federal tax credits are a great way to turn tax season in your favor, and many keen consumers are always on the hunt for a new way to reduce their taxable income as much as possible. Tax credits for new EVs are a great way to achieve this while also contributing to the Herculean shift occurring in the present.

Adopting EVs en masse is an important step toward better climate stewardship that might just leave the planet better off. Globally and within the U.S. government, policy objectives often revolve around carbon emission reduction, and this is what the federal EV tax credits are aimed at creating. If you're in the market for a new car in 2024, the EV space looks quite enticing with these solid incentives built into the purchase.

Eligibility requirements: A focus on 'homegrown' manufacturing

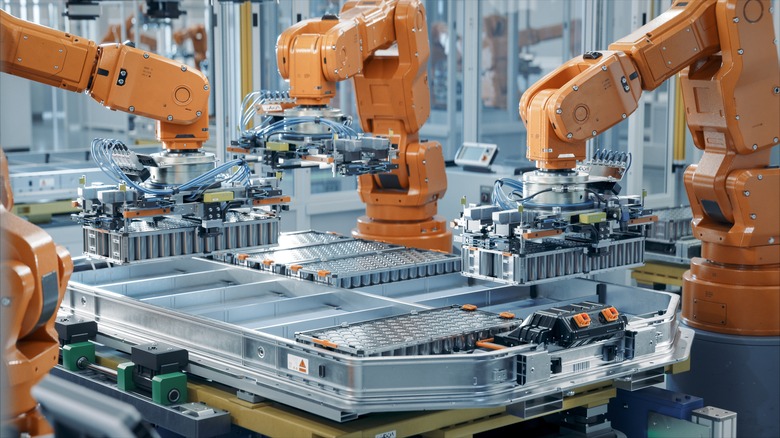

The federal tax credits governing EV sales are broken into two parts. This is the first piece of information that anyone looking to utilize the program will need to understand. These components break the tax credit into two segments, meaning a car may qualify for one or both halves of the total credit offered. For qualification in the 2024, EV batteries must have at least 50% of their critical minerals sources from the United States or nations with a free trade agreement with the U.S. (of which 21 countries qualify including Australia, Colombia, Japan, and Canada). Meeting this threshold is the first qualification requirement for a vehicle's access to a $3,750 portion of the total credit. These figures will increase in years to come, however. In 2025 this figure will hit 60%, and by 2027 the requirement will rise to 80%.

Additionally, manufacturers who build their batteries with at least 60% of their components coming from free trade countries or the U.S. gain access to the other half of the tax credit for consumers. This requirement, too, will increase, rising to 100% in 2029. The same MSRP requirements remain in effect, with vans, SUVs, and trucks qualifying with a figure up to $80,000 and other EVs qualifying with an MSRP capped at $55,000. Finally, qualified buyers can take advantage of the credit with an AGI capped at $150,000 for single filers, $225,000 for heads of household, and $300,000 for joint filers.

'Foreign entities of concern' and policy ramifications

In addition to the basic eligibility requirements, U.S. posture toward "foreign entities of concern" will change radically starting in 2025. While the criteria today stands as a basic threshold, EVs with any components sourced from yet-to-be-defined "foreign entities of concern" will be excluded entirely. This could shape up to mean many things, but U.S. policymakers are likely seeking to limit Chinese influence in the domestic EV marketplace. China is a primary driver in the EV manufacturing and mineral resource space, and this is something that American competitors (and policymakers) want to counter. Supply chain control is a concern in this space and beyond, so limiting reliance on Chinese resources without a direct confrontation will be an important step toward greater U.S. resiliency in the EV market.

In addition, the Democratic Republic of the Congo is particularly rich in mineral resources like cobalt, lithium, and nickel. African nations across the continent are poised to become major players in the renewable energy resource trade. However, the marketplace is already shaping up in a way that loosely resembles the abusive and highly problematic regional diamond trade, according to Amnesty International. Moreover, experts suggest (via Foreign Policy) that resource extraction aimed at meeting EV transition targets cannot keep up with the pace of demand without reverting to systems similar to the colonial repression responsible for decimating the Global South. This language provides an opportunity to confront human rights abuses and other systemic issues in the supply chain.

Additional restrictions to keep in mind

In addition to the basic qualification criteria, it's important to note a few additional features of the tax credit that buyers will want to take note of. The tax credits are non-refundable. This means that you can't accumulate a larger refund directly. If your tax bill comes out to $3,000 and you qualify for one-half of the credits with your purchase, you don't get the added $750 back. Similarly, you also can't roll it over for use in the following tax year.

Some Plug-in Hybrid models also qualify for tax credits, and buyers looking at used EVs can also utilize this federal tax incentive, too. More importantly, perhaps, it looks as if the credits will be transitioned at some point in 2024 to allow for use as a price reduction at the point of sale rather than as a tax vehicle later on. This could make for a more valuable incentive for buyers, but it's worth speaking with your local dealership and waiting for additional news before baking this option into your plans for a new car. Lastly, the federal government has previously capped EV sales per manufacturer at 200,000, meaning once an automaker hits this limit, tax incentives are halted. The cap has been lifted and buyers are again able to utilize tax credits on previously excluded models.

Models covered by federal credits: Tesla

The Tesla brand retains five vehicles that qualify for federal EV credits in 2024. Four Teslas qualify in both the 2023 and 2024 model years, and the fifth, the 2024 Model Y Real-Wheel Drive qualifies (but not the 2023 build). All five cars offer the maximum, $7,500 credit, allowing buyers the full weight of the incentive.

The four other vehicles that can provide this incentive are the Model 3 Performance, Model X Long Range, Model Y All-Wheel Drive, and the Model Y Performance. If you're thinking of purchasing a Tesla, it's worth contacting your local dealership regarding the tax credit and potential for a markdown rather than a future reduction of your taxable income. Because Tesla's vehicles are routinely purchased through the company's website or app, you may not actually interact with a salesperson if you don't go out of your way to create a dialogue.

Ford

Two Ford models make the cut for the new 2024 restrictions (as well as a third, PHEV model discussed below). The F-150 Lightning alone (in two configurations) is covered by the EV tax credit, allowing for the maximum write-off of $7,500. Buyers eyeing up a 2022, 2023, or 2024 model year for the F-150 Lightning in either the Extended Range Battery or Standard Range Battery trim will be able to utilize the tax credit.

Both trucks make for a great upgrade over an existing pickup you might have parked in the driveway or garage. Either build comes with dual electric motors, and the standard battery configuration produces 452 horsepower while the upgraded battery generates 580. The truck is 'lightning' fast and can tow 7,700 and 10,000 pounds respectively. F-150 Lightning buyers also won't have to worry too much about ensuring their preferred vehicle falls into the eligibility criteria since the Lightning only hit the market with a 2022 release.

Chevrolet

Chevrolet offers just two builds that qualify for the new regulations for federal EV tax credits. The Chevy Bolt EUV and Bolt EV, both in model years 2022 and 2023 (but not 2024 builds), qualify for both halves of the federal tax credit. This means buyers can leverage the entire $7,500 sum on their upcoming tax bill by purchasing one of these two models.

The two models offer a divergence that buyers are sure to welcome. While the overall footprint of both EVs is roughly similar in shape, the Bolt EUV is a crossover model that closely imitates the SUV framework while the Bolt EV is a smaller hatchback. This means that buyers can take advantage of the EV tax credits while opting for a great car in either sizing category. Each model offers the same front-wheel drive configuration and torque output (226 pound-feet), but the EV offers a slightly improved range — 259 miles versus the EUV's 247 miles on a full charge.

Rivian

Rivian is a direct Tesla competitor and focuses exclusively on the production of truck and SUV-style vehicles. Rivian models are large, powerful, and fully electric, of course. Five Rivian models qualify for tax credits under the 2024 guidelines, but all of them only meet the requirements for only the first threshold — with battery components not rising to the 60% sourcing criteria. As a result, Rivian buyers can take advantage of a $3,750 tax credit when filing rather than the full $7,500 offered for some other vehicles. All Rivian vehicles qualifying under the current criteria can be purchased in either the 2023 or 2024 model year releases while gaining access to the credits. Rivian notes that some configurations can be delivered with a lead time of two weeks or less, making this purchase a potentially quick acquisition, too!

Rivian models available with this added credit in place are the R1S Dual Motor Large Pack, R1S Quad Motor Large Pack, R1T Dual Motor Large Pack, R1T Dual Motor Max pack, and the R1T Quad Motor Large Pack.

Volkswagen

Volkswagen offers a range of qualifying vehicles, as of January 24, 2024. Initially no Volkswagens were included in the very slim qualifying list, but this has since changed. In total, buyers can utilize the purchase of eight different Volkswagen models to gain access to the full $7,500 tax credit. All eight models are available in either 2023 or 2024 model year builds.

All eight models are variations of Volkswagen's ID.4 EV. The 2023 Pro trim (included in the qualifying models) gets an estimated 275 miles of range on a full charge, and the vehicle requires between 30 and 36 minutes to attain an 80% charge (from 10%) with a DC public fast charger. Included in the qualifying lineup are: The ID.4 AWD Pro, ID.4 AWD Pro S, ID.4 AWD Pro S Plus, ID.4 Pro, ID.4 Pro S, ID.4 Pro S Plus, ID.4 S, and the ID.4 Standard. To sweeten the pot, Volkswagen includes three years of unlimited 30-minute charging sessions with Electrify America charging infrastructure (at DC fast charging stations).

Qualifying Plug-in Hybrids

There are five Plug-in Hybrid Vehicles (PHEVs) that also qualify for federal tax credits in 2024. To qualify, Plug-in Hybrids must meet the same manufacturing and component usage requirements that govern qualification for full EVs. This means the same MSRP thresholds of $55,000 for standard vehicles and $80,000 for SUVs, trucks, and vans. Qualified vehicles will also incorporate at least 50% of essential battery minerals from a U.S. source or a country with an eligible trade agreement. Also, to qualify for the second half of the tax credits offered, PHEVs will need to utilize battery components sourced from the U.S. and trade agreement nations at a level of 60%.

As of January's end (2024), five vehicles qualify: The Chrysler Pacifica PHEV (model years 2022, 2023, and 2024), the 2022-2024 Ford Escape Plug-in Hybrid, the Jeep Grand Cherokee PHEV 4xe (2022-2024) and Wrangler PHEV 4xe (model years 2022 to 2024), and the Lincoln Corsair Grand Touring from model years 2022 to 2024. The Chrysler Pacifica is the only PHEV model to qualify for both credit components, meaning it offers the full $7,500 tax credit. The other four vehicles offer a total tax credit of $3,750, qualifying for the first half of the credits but not the second.

Used electric vehicles

In addition to new EVs and PHEVs, buyers in the market for an electric vehicle can purchase a used car and still take advantage of federal tax credits. There is up to $4,000 credit available for qualified vehicles and buyers, making a larger segment of the EV marketplace open to this lucrative incentive. The incentive is percentage-based, equaling 30% of the sale price, and capped at $4,000. Therefore, if you purchase a vehicle for $16,000, or $24,000, you'll get the maximum, $4,000 tax credit.

To qualify buyers (individual buyers, not business entities) need to purchase a used EV from a dealership for a price capped at $25,000. Additionally, the car must be at least two years old. Therefore, a buyer in 2024 will need to opt for a 2022 model year or older to qualify. A car can't qualify for this tax credit more than once either. So, you'll need to ensure that the vehicle you're looking at hasn't already been purchased and claimed for this tax benefit by another owner. AGI thresholds for this tax credit stand at $75,000 for individual buyers, $112,000 for heads of household, and $150,000 for joint filers. Also, you don't personally qualify if you've cashed in on a used vehicle tax credit in the three years prior to this purchase.

Newly non-qualified vehicles

With assembly and battery component restrictions officially rolling out with the new year, the list of EVs that qualify for federal tax credits fell from 43 down to around half that. Manufacturers are sure to make alterations in their supply chain to accommodate for these regulation changes, but early on it isn't likely that much will occur with any haste (with the addition of Volkswagen models coming as the first change to the qualifying list). Automakers won't want to provide a product that doesn't include this incentive for long. Competition in the vehicle market is a pitched battle, and any hiccup in a brand's ability to successfully offer a competitive product can severely hinder its long-term profits and stature in the wider marketplace. Changing regulations appear focused primarily on materials and parts sourced from China, making the job of qualification difficult for some. China is the industry leader in material refinement in the EV battery space, but raw materials for batteries are sourced all over the world (including in China and the Democratic Republic of the Congo, which also isn't on the list of countries with Free Trade Agreements).

Newly disqualified cars include the Ford E-Transit, numerous Tesla 3 models, the Nissan Leaf, and the Chevrolet Blazer EV. If you have one of these vehicles in mind, it's worth looking elsewhere. It's entirely possible, however, that many of the newly excluded models ultimately regain compliance with the tax credit regulations.