The One Type Of Credit Card Dave Ramsey Warns To Avoid At All Costs

Used properly, credit cards can be a powerful financial tool. To begin, they offer an interest-free grace period of at least a few weeks before requiring any payment. Many credit cards also reward spending with cash back or other awards, such as travel points or frequent flyer miles. Finally, you can score free perks, like extended warranties and/or insurance against damage, loss, or theft of purchases made with the card.

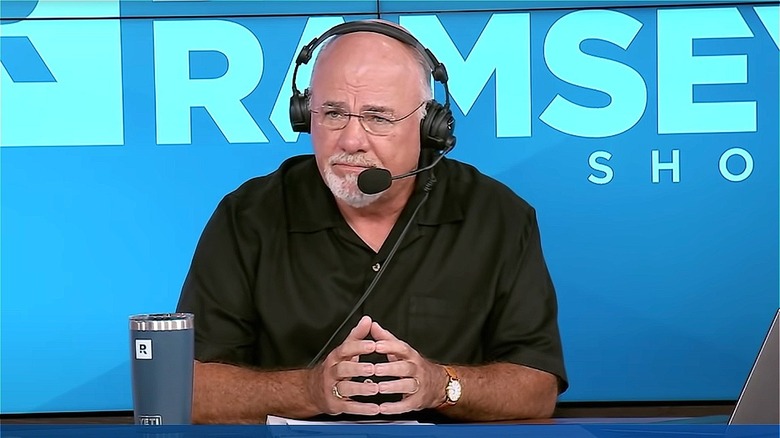

The credit bureau Experian reports the average American has 3.84 credit cards, which is 3.84 too many for Dave Ramsey, a personal finance expert, bestselling author, and syndicated radio host. In fact, Ramsey eschews credit cards of any ilk ("I don't own a credit card; I haven't in decades," he shared on his podcast) — a stance that Money Digest will agree to disagree with. This said, we do agree with Ramsey on one type of credit card you should avoid: store credit cards.

Store credit cards, promotions, and overspending

One aspect of store cards that Dave Ramsey particularly detests is that they encourage unnecessary spending via frequent promotions. Sure, you might save on that first purchase that you were going to make anyway, but it won't be long before your inbox is full of messages teasing you about special sales and coupons for cardholders only. But, these stores aren't doing you any favors or trying to save you money. Instead, they're counting on the fact that dangling a great deal in front of consumers will lead to impulse purchases. As Ramsey says about credit card use, in general, it leads you to spend more than you were going to. "It reduces the emotional friction," he says, "and that's why everyone wants you to use plastic."

Further, Ramsey's daughter, Rachel Cruze, notes many store credit cards offer consumers low (or even 0%) interest rates initially in an attempt to get them to purchase more. However, once the teaser period expires after several months, you'll be on the hook for any unpaid balance to the tune of 20% interest or more. That could cost you hundreds, or even thousands, of dollars in interest and credit card fees over the life of the debt. Speaking on this topic, Ramsey said in another podcast, "Listen, these companies, these retailers, make more on credit card interest than they do on the sale of the stuff. All of them do."

In defense of certain store credit cards

In defense of the much-maligned store-specific card, some are better than others, at least for certain shoppers. For example, the Target RedCard and the Lowe's Advantage Card both offer cardholders a 5% discount on nearly all store products. For this reason, such cards would make sense for frequent shoppers at these establishments, but do be diligent about paying the billing statement in full each month to avoid interest expenses.

Another consideration is that certain store-branded credit cards have a more useful double identity. That is, while most store cards can only be used at that particular retailer or ownership group — like how Gap also owns Old Navy and Banana Republic — a select few can function just like a regular Visa or Mastercard. For example, Amazon's Prime Visa gives 5% cash back at Amazon.com and at Whole Foods Market, as well as 1% cash back everywhere else. Apple has a similar setup with its Apple Card (a Mastercard), as does Costco with its Anywhere Visa. That kind of flexibility makes keeping a store card in your credit portfolio easier to justify.

Finally, the application process for store-only credit cards is typically quicker and easier to get approved for than traditional bank-issued cards. That ease of approval can be an asset to consumers just setting out to establish a stable credit history; however, if you do, just remember to use that newfound power wisely. As Dave Ramsey warns, don't fall into that trap, for a paltry one-time discount.