How Much Of Your Income Should You Spend On An Engagement Ring?

Buying an engagement ring can be a stressful, confusing, and unnecessarily expensive experience. You've probably heard a person should spend anywhere between one and three months of their salary on a ring in order to prove ... something. Jewelry retailers rely heavily on emotional motivators and often use the concept that the price of an engagement ring is indicative of the quantity and/or quality of a person's love, with a more expensive ring somehow equating to a higher level of devotion. This marketing has successfully fueled the engagement ring industry for almost a hundred years. However, as engagement ring prices and salary rules have continued to rise, younger generations are increasingly refusing to participate.

Engagement ring-income rules aren't financially viable for most people, especially when you consider that wages for millennials have been lower than previous generations and relatively stagnant. It's also important to mention that these so-called rules were actually invented by advertising agencies during the Great Depression in order to sell diamonds. Not only were these rules created solely to ensure profitability for unethical diamond cartels, but these rules have also continued to inflate the "traditional" price tag rules throughout the years, despite worsening economic prospects for younger generations.

This leaves millennials and, more recently, Gen Z to navigate antiquated salary-based price tag rules and traditions for engagement rings while simultaneously struggling with increased financial strain from student loan debt and the housing crisis. It's no wonder these generations are saying no to pricey engagement rings.

Where did these salary-based rules come from?

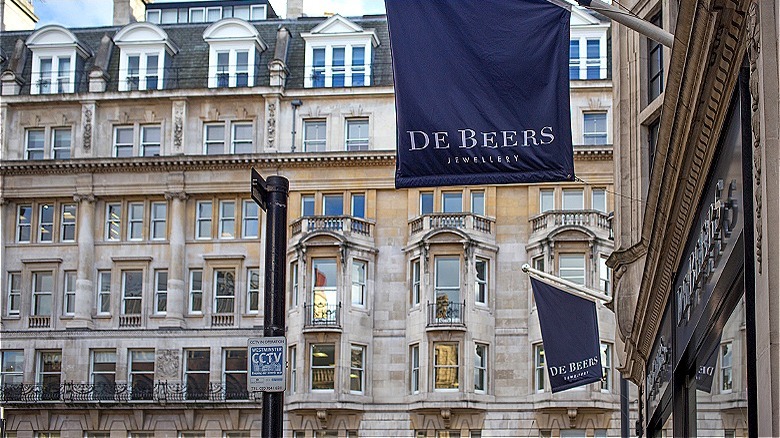

The three-month-salary rule comes from a 1930s marketing campaign. De Beers, a leading diamond cartel that controlled 60% of all rough diamond output at the time, was looking for a way to drum up sales. The Great Depression had caused an obvious drop in diamond sales, so De Beers began what would become one of the most successful marketing campaigns of all time by accomplishing two things: tying a person's income to engagement ring prices and linking diamonds to engagement rings.

Even though the catchphrase "A Diamond Is Forever" still persists today, you might be interested to know that before this De Beer's marketing campaign, only about 10% of engagement rings even contained diamonds. They were certainly not seen as the pinnacle of engagement ring stones the way they generally are today. It's also important to realize that, in the United States, the original De Beers campaign promoted the idea that a single month's salary was the correct amount of one's income to spend on an engagement ring. This amount proved a person's devotion and served as a way to quantifiably put a price tag on love.

However, De Beers also very successfully launched this campaign in Japan, where diamond engagement rings were entirely unheard of before WWII. And, unlike the more modest U.S. price tag, in Japan, the suggested price tag was three months of one's income. The U.S. campaign shifted to a two-month-salary price tag in the 1980s and has continued increasing in recent years alongside inflation.

Is anyone following these rules today?

According to a 2022 study conducted by The Knot, the average price of an engagement ring today is around $6,000. Basic math would dictate that a person's annual income is only $24,000 if they were following the three-month-salary rule. However, in 2022, the inflation-adjusted median household income in the U.S. was $74,580. This would equate to a ring that costs over $18,000, so it's safe to say that most people (technically 7% of people spend over $10,000 on a ring) are not following the newer (and higher) engagement price rules, but are, on average, sticking to the original one-month-salary rule. Some, the study found, are even coming in under, with 8% reporting that they spent less than $1,000.

It's also worth mentioning that, among the many things millennials are blamed for, their lack of interest in diamonds is seen as a contributing factor in the decline of the diamond industry. Increasingly, the issues of slavery, unsafe mining conditions, and even blood diamonds have damaged the diamond's image for younger generations. These often unethical practices have pushed more young people to shy away from diamonds altogether or to seek out ethically sourced stones (including lab-grown varieties) whenever possible. This, in combination with the fact that millennial spending habits are focused more on food and basic needs than previous generations, has led companies like De Beers to cut prices by sometimes as much as 40% (via Fortune). All of this is to say, no, most younger people are not following either the diamond or three-month-salary traditions anymore.